American Fidelity Disability Insurance Brochure

American Fidelity Disability Insurance Brochure - Means your disability benefit minus Couldn’t work for a period of time? American fidelity’s disability income insurance is designed to help protect you if you become disabled and cannot work due to a covered accidental injury or sickness. Disability income insurance can help protect your future finances in case of a sudden covered injury or illness by providing a benefit to help cover expenses while you’re unable to work. This is a brief overview of the benefits available under the group policy underwritten by american heritage life insurance company (home office, jacksonville, fl). What would you do if you experienced a disability today and your paycheck suddenly stopped? People with disabilities are entitled, as a matter of law, to fair and equal opportunities in all aspects of society. Provides a steady benefit to cover expenses while you are unable to work. However, you should consult with a financial advisor before buying any insurance. When filing a disability insurance claim, you will need to provide the following documentation: Provides a steady benefit to cover expenses while you are unable to work. Discover strategies to support benefit decisions, engage your workforce, and improve your bottom line. What would you do if you experienced a disability today and your paycheck suddenly stopped? Provides a steady benefit to cover expenses while you are unable to work. This is a brief overview of the benefits available under the group policy underwritten by american heritage life insurance company (home office, jacksonville, fl). Read our complete 2021 american fidelity disability insurance review. Ł provides a benefit to help cover costs while you are unable to work. Use this worksheet to get a general estimate of how much disability income protection insurance you need. Disability or disabled mean you are unable to perform the material and substantial duties of your regular occupation. Couldn’t work for a period of time? The plan makes it easy to help protect your future income in case of a. When filing a disability insurance claim, you will need to provide the following documentation: Use this worksheet to get a general estimate of how much disability income protection insurance you need. The attorney general's disability rights bureau enforces state and federal. Means your disability benefit. Read our complete 2021 american fidelity disability insurance review. Disability income insurance ł helps protect your finances in case of a covered injury or illness. Ł provides a benefit to help cover costs while you are unable to work. Discover strategies to support benefit decisions, engage your workforce, and improve your bottom line. Use this worksheet to get a general. Disability income insurance can help protect your future finances in case of a sudden covered injury or illness by providing a benefit to help cover expenses while you’re unable to work. Provides a steady benefit to cover expenses while you are unable to work. Nearly 70% of american employees live paycheck to paycheck 1 , staying current on bill. Discover. Provides a steady benefit to cover expenses while you are unable to work. When filing a disability insurance claim, you will need to provide the following documentation: Nearly 70% of american employees live paycheck to paycheck 1 , staying current on bill. American fidelity’s disability income insurance is designed to help protect you if you become disabled and cannot work. The plan makes it easy to help protect your future income in case of a. Use this worksheet to get a general estimate of how much disability income protection insurance you need. Means your disability benefit minus However, you should consult with a financial advisor before buying any insurance. Provides a steady benefit to cover expenses while you are unable. Read our complete 2021 american fidelity disability insurance review. Disability or disabled mean you are unable to perform the material and substantial duties of your regular occupation. Statement of insured, completed through your online account during the claim filing process;. However, you should consult with a financial advisor before buying any insurance. The plan makes it easy to help protect. Couldn’t work for a period of time? The plan makes it easy to help protect your future income in case of a sudden injury or sickness. Discover strategies to support benefit decisions, engage your workforce, and improve your bottom line. Read our complete 2021 american fidelity disability insurance review. However, you should consult with a financial advisor before buying any. We can provide personalized support to help employees stay at work or get back to work safely. The plan makes it easy to help protect your future income in case of a. The attorney general's disability rights bureau enforces state and federal. Use this worksheet to get a general estimate of how much disability income protection insurance you need. Couldn’t. However, you should consult with a financial advisor before buying any insurance. Provides a steady benefit to cover expenses while you are unable to work. This is a brief overview of the benefits available under the group policy underwritten by american heritage life insurance company (home office, jacksonville, fl). People with disabilities are entitled, as a matter of law, to. Couldn’t work for a period of time? The plan makes it easy to help protect your future income in case of a. This is a brief overview of the benefits available under the group policy underwritten by american heritage life insurance company (home office, jacksonville, fl). Nearly 70% of american employees live paycheck to paycheck 1 , staying current on. Statement of insured, completed through your online account during the claim filing process;. Disability or disabled mean you are unable to perform the material and substantial duties of your regular occupation. However, you should consult with a financial advisor before buying any insurance. Discover strategies to support benefit decisions, engage your workforce, and improve your bottom line. Disability income insurance can help protect your future finances in case of a sudden covered injury or illness by providing a benefit to help cover expenses while you’re unable to work. This is a brief overview of the benefits available under the group policy underwritten by american heritage life insurance company (home office, jacksonville, fl). Disability income insurance is here for you. Provides a steady benefit to cover expenses while you are unable to work. Means your disability benefit minus The attorney general's disability rights bureau enforces state and federal. Read our complete 2021 american fidelity disability insurance review. What would you do if you experienced a disability today and your paycheck suddenly stopped? Ł provides a benefit to help cover costs while you are unable to work. The plan makes it easy to help protect your future income in case of a. The plan makes it easy to help protect your future income in case of a sudden injury or sickness. Nearly 70% of american employees live paycheck to paycheck 1 , staying current on bill.American Fidelity Disability Insurance 2025 Review Breeze

Who needs disability insurance? American Fidelity

Top largegroup disability insurance carriers EBA Employee Benefit News

Disability Insurance Brochure Template Venngage

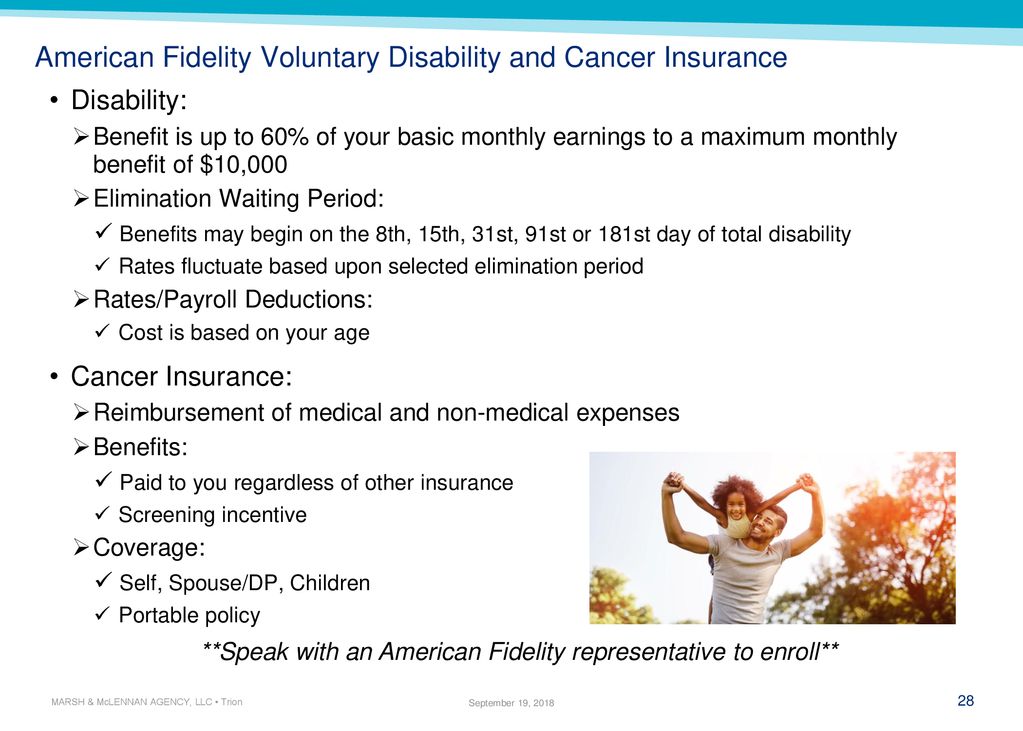

BENEFITS PRESENTATION ppt download

Fillable Online Disability American Fidelity Fax Email Print pdfFiller

BENEFITS PRESENTATION ppt download

Insurance California School Employees Association

Brochure American Fidelity.pdf (2) PDF

IUL Brochure AMERICAN FIDELITY INDEX PDF

However, You Should Consult With A Financial Advisor Before Buying Any Insurance.

Use This Worksheet To Get A General Estimate Of How Much Disability Income Protection Insurance You Need.

We Can Provide Personalized Support To Help Employees Stay At Work Or Get Back To Work Safely.

Use This Worksheet To Get A General Estimate Of How Much Disability Income Protection Insurance You Need.

Related Post: