Fincen Boi Brochure

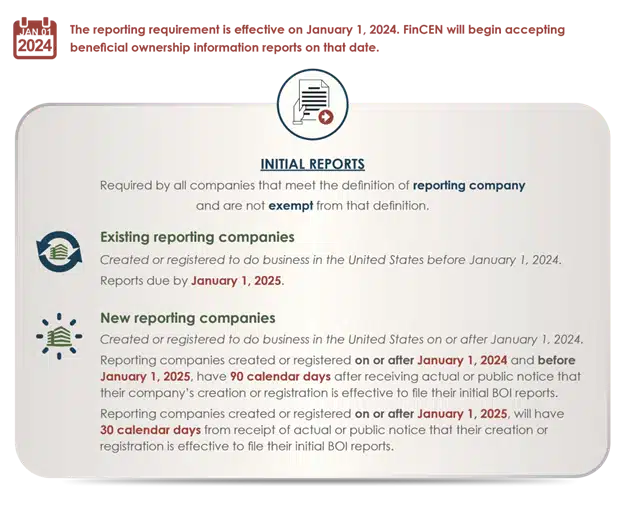

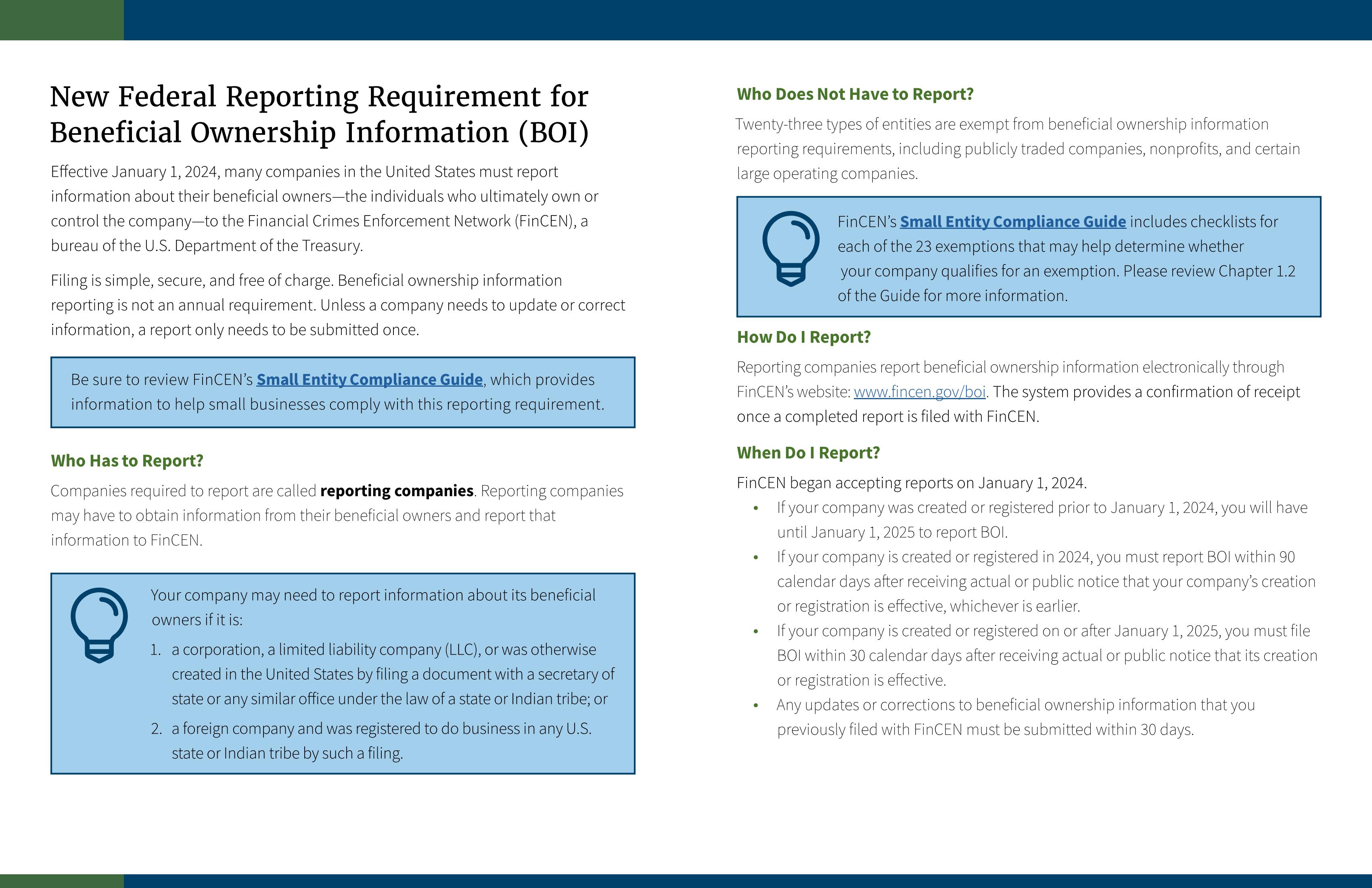

Fincen Boi Brochure - Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. Alert [updated march 26, 2025]: Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. As we previously discussed and in alignment with the u.s. The preamble to the reporting rule also noted that while fincen's 2016 customer due diligence rule increased transparency by requiring covered financial institutions. Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. Fincen has published a new informational brochure, an introduction to beneficial ownership information reporting, and updated its beneficial ownership information. Reporting companies report beneficial ownership information electronically through fincen’s website: All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. Treasury department’s previous announcement, on march 21, 2025, the financial crimes enforcement network. Effective march 26, 2025, the u.s. The rule requires most corporations, limited liability companies (llcs), and other entities established in or registered to operate within the united states to report their beneficial owners. Department of the treasury and the financial crimes enforcement network (fincen) have dramatically scaled back the scope of the. Fincen has announced that beneficial ownership information (boi) reporting is now a requirement (no longer just voluntary) with a filing deadline of march, 21 2025. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. Under the rule, domestic reporting companies are exempt from boi reporting. The preamble to the reporting rule also noted that while fincen's 2016 customer due diligence rule increased transparency by requiring covered financial institutions. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. As we previously discussed and in alignment with the u.s. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. Fincen has published a new informational brochure, an introduction to beneficial ownership information reporting, and updated its beneficial ownership information. File your report resources to learn more Beneficial owners are now. As we previously discussed and in alignment with the u.s. Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. Effective march 26, 2025, the u.s. Department of the treasury and the financial crimes enforcement network (fincen) have dramatically scaled back the scope of the. Alert [updated march 26, 2025]: As. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. File your report resources to learn more Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. Beginning on january. Alert [updated march 26, 2025]: Department of the treasury and the financial crimes enforcement network (fincen) have dramatically scaled back the scope of the. The preamble to the reporting rule also noted that while fincen's 2016 customer due diligence rule increased transparency by requiring covered financial institutions. Beneficial owners must file boi reports with fincen. All entities created in the. Alert [updated march 26, 2025]: The system provides a confirmation of receipt once a completed. Www.fincen.gov/boi sign up for fincen updates to receive immediate email updates on beneficial ownership. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. You can easily report your company’s beneficial ownership. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. Treasury department’s previous announcement, on march 21, 2025, the financial crimes enforcement network. Alert [updated march 26, 2025]: The preamble to the reporting rule also noted that while fincen's 2016 customer due. Beginning on january 1, 2024, many companies in the united states will have to report information about their beneficial owners, i.e., the individuals who ultimately own or control the. Fincen boi guidance april 2023 on 3/24/23, fincen issued its first set of guidance materials to aid the public in understanding upcoming beneficial ownership information (boi) reporting. Treasury department’s previous announcement,. The preamble to the reporting rule also noted that while fincen's 2016 customer due diligence rule increased transparency by requiring covered financial institutions. Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. Www.fincen.gov/boi sign up for fincen updates to receive immediate email updates on beneficial ownership. Fincen has announced that beneficial ownership information (boi) reporting. This pamphlet is explanatory only and does not supplement or modify any. Fincen has invited comments on the rule and plans to issue a final rule later this year. The financial crimes enforcement network (fincen) of the u.s. Treasury department today issued additional guidance materials for the beneficial ownership information (boi) reporting. Reporting companies report beneficial ownership information electronically through. Treasury’s financial crimes enforcement network (fincen) issued a major revision to the corporate transparency act’s beneficial ownership information. File your report resources to learn more Department of the treasury and the financial crimes enforcement network (fincen) have dramatically scaled back the scope of the. This pamphlet is explanatory only and does not supplement or modify any. You can easily report your company’s beneficial ownership information (boi) electronically through fincen’s website. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. All entities created in the united states — including those previously known as “domestic reporting companies” — and their beneficial owners are now. Reporting companies report beneficial ownership information electronically through fincen’s website: Alert [updated march 26, 2025]: Beneficial owners are now exempt from the requirement to report beneficial ownership information (boi) to the financial crimes enforcement network (fincen) under the corporate. Under the rule, domestic reporting companies are exempt from boi reporting. The system provides a confirmation of receipt once a completed. Effective march 26, 2025, the u.s. Treasury department’s previous announcement, on march 21, 2025, the financial crimes enforcement network. Alert [updated march 26, 2025]: Beneficial owners must file boi reports with fincen.FINCEN BOI Reporting Tax1099 Blog

FinCEN Publishes Initial Guidance and FAQs on BOI Reporting Under CTA

FinCEN's BOI Form New Reporting Requirement For Small Businesses

How To File The BOI Report With FINCEN Correctly Guide to Beneficial

Do I Need To File The FINCEN BOI Report Every Year? FreedomTax

How to correctly file the BOI with FinCEN.

FinCEN BOI Reporting Don't Miss Filing

FINCEN BOI Report (Step by Step Instructions Guide) FreedomTax

Beneficial Ownership Information Grandview Bank

A Guide to FinCEN BOI, Beneficial Ownership Information 1800Accountant

Certain Types Of Corporations, Limited Liability Companies, And Other Similar Entities Created In Or Registered To Do Business In The United States Must Report Information About Their Beneficial.

Fincen Has Announced That Beneficial Ownership Information (Boi) Reporting Is Now A Requirement (No Longer Just Voluntary) With A Filing Deadline Of March, 21 2025.

Beginning On January 1, 2024, Many Companies In The United States Will Have To Report Information About Their Beneficial Owners, I.e., The Individuals Who Ultimately Own Or Control The.

Go To Fincen.gov/Boi To Determine If Your New Entity Needs To Report Information About Its Beneficial Owners—The Real People Who Ultimately Own Or Control The Company—To.

Related Post: