Pa Able Brochure

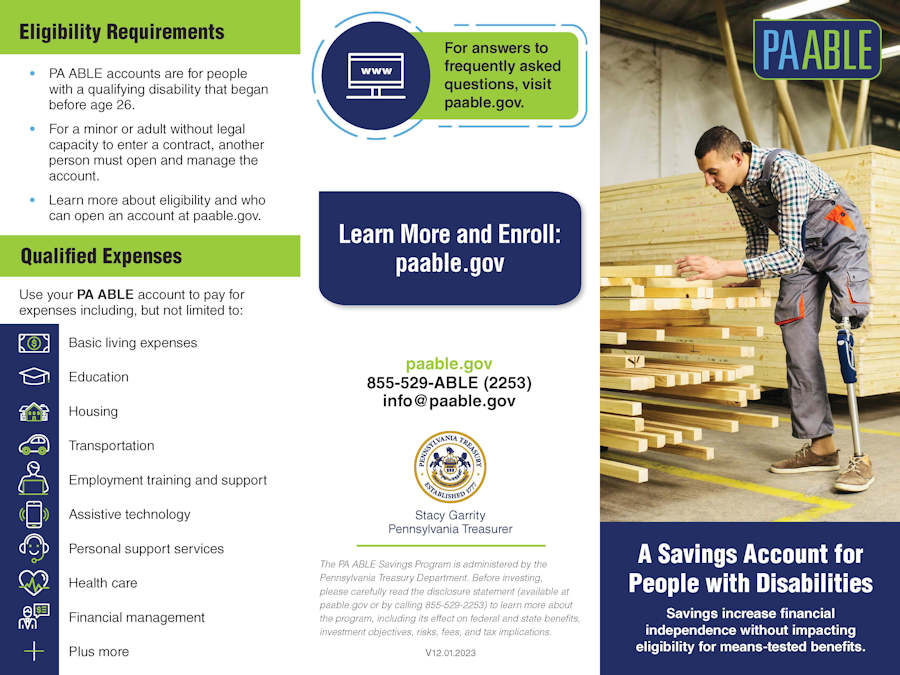

Pa Able Brochure - Pennsylvania’s able program provides individuals with qualifying disabilities a way to save and invest without affecting their benefits. A lot has happened in the last. I’m pleased to share this enrollment guide for the pa able savings program with you. The pa able savings program (pa able) helps people with disabilities (eligible individuals) save money for a wide range of qualified disability expenses without jeopardizing government. Pa able savings program specifically designed for people with disabilities to: Read on to learn how this program, modeled after the federal legislation that authorized states to create their own able plans, allows individuals with disabilities and their. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. The account owner must also meet one of the requirements below. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. This guide useful in gaining access to the incredible benefits pa able provides. • pa able accounts are for people with a qualifying disability that began before age 26. Cost share reductionfinancial assistancetax creditscompare options A lot has happened in the last. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. Plus, savings benefit from several great. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. I’m pleased to share this enrollment guide for the pa able savings program with you. Plus, savings benefit from several great. What is new with able? This guide useful in gaining access to the incredible benefits pa able provides. Plus, savings benefit from several great. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. The pa able savings program (pa able) helps people with disabilities (eligible individuals) save money for a wide range of qualified disability expenses without jeopardizing. Plus, savings benefit from several great. This guide useful in gaining access to the incredible benefits pa able provides. Those benefits have the potential to change the lives of people with disabilities, caregivers, families, and loved. The pa able savings program (pa able) helps people with disabilities (eligible individuals) save money for a wide range of qualified disability expenses without. Cost share reductionfinancial assistancetax creditscompare options Pa able savings program specifically designed for people with disabilities to: The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. To be eligible for an able account, the account owner’s disability must have begun. What is new with able? Plus, savings benefit from several great. Pennsylvania’s able program provides individuals with qualifying disabilities a way to save and invest without affecting their benefits. The pennsylvania treasury offers materials to disability and mental health organizations to help them share information about pa able accounts with their staff, members or the individuals. The pennsylvania able savings. I’m pleased to share this enrollment guide for the pa able savings program with you. Plus, savings benefit from several great. • pa able accounts are for people with a qualifying disability that began before age 26. Plus, savings benefit from several great. • plan for a financially secure future. • plan for a financially secure future. A lot has happened in the last. • pa able accounts are for people with a qualifying disability that began before age 26. Plus, savings benefit from several great. The pa able savings program (pa able) helps people with disabilities (eligible individuals) save money for a wide range of qualified disability expenses without. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. Pennsylvania’s able program provides individuals with qualifying disabilities a way to save and invest without affecting their benefits. Inside, you’ll find details about the program’s tax benefits, account eligibility and control,. The account owner must also meet one of the requirements below. The pa able savings program (pa able) helps people with disabilities (eligible individuals) save money for a wide range of qualified disability expenses without jeopardizing government. To be eligible for an able account, the account owner’s disability must have begun before the age of 26. Cost share reductionfinancial assistancetax. Pennsylvania’s able program provides individuals with qualifying disabilities a way to save and invest without affecting their benefits. • for a minor or adult without legal capacity to enter a contract, another person must open and. Read on to learn how this program, modeled after the federal legislation that authorized states to create their own able plans, allows individuals with. Those benefits have the potential to change the lives of people with disabilities, caregivers, families, and loved. What is new with able? The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. Plus, savings benefit from several great. Pennsylvania’s able program. Pa able savings program specifically designed for people with disabilities to: The pa able savings program (pa able) helps people with disabilities (eligible individuals) save money for a wide range of qualified disability expenses without jeopardizing government. • plan for a financially secure future. I’m pleased to share this enrollment guide for the pa able savings program with you. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. The pennsylvania able savings program (pa able) allows people with disabilities and their families to have greater control of their finances and to plan for a more financially secure. Pennsylvania’s able program provides individuals with qualifying disabilities a way to save and invest without affecting their benefits. • pa able accounts are for people with a qualifying disability that began before age 26. Read on to learn how this program, modeled after the federal legislation that authorized states to create their own able plans, allows individuals with disabilities and their. Cost share reductionfinancial assistancetax creditscompare options A lot has happened in the last. • for a minor or adult without legal capacity to enter a contract, another person must open and. Plus, savings benefit from several great. Those benefits have the potential to change the lives of people with disabilities, caregivers, families, and loved. Plus, savings benefit from several great. This guide useful in gaining access to the incredible benefits pa able provides.County of Mercer Mental Health and Intellectual Disability Department

3/21/17 The MLO Minute PA ABLE Savings Program Launch! McAndrews

PA ABLE A savings plan for people with disabilities Suasion

PA ABLE Savings Program

PA ABLE A savings plan for people with disabilities Suasion

Pittsburgh Parent on Twitter "PA ABLE accounts can be used to save and

PA ABLE & 529 Savings Programs The Arc of Lehigh and Northampton Counties

Marketing Case Study — PA ABLE Savings Plan Suasion

Outreach Materials for PA ABLE

Learn about the PA ABLE Savings Program YouTube

What Is New With Able?

Inside, You’ll Find Details About The Program’s Tax Benefits, Account Eligibility And Control, As Well As.

To Be Eligible For An Able Account, The Account Owner’s Disability Must Have Begun Before The Age Of 26.

The Account Owner Must Also Meet One Of The Requirements Below.

Related Post: